what is a provisional tax code

When you file your income tax return and calculate your tax for the year you deduct the provisional tax you paid earlier. Provisional tax payments can be made up of.

Clarification To Pensioners About Suggestion To Hike Exemption Limit To Rs 5 Lakhs

Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate.

. The definition according to the first paragraph of the 4th Schedule of the Income Tax Act No58 of 1962 is that any. This means that they have to pay provisional tax of 10000 X 105 10500 in the current financial year. This means that they are not employed but get some form of regular income.

The provisional tax is actually the payment in advance of this years income tax. The income tax on this profit is figured out by multiplying the net profit by 125 the Cyprus income tax rate. They go towards the tax payable on income with no tax credits attached.

PROVISIONAL TAX What is this tax. Provisional income is calculated by. Several factors are assessed when calculating provisional income levels.

In some cases if your provisional tax paid is less than your RIT Inland Revenue may charge you interest. The first provisional tax return must be submitted within the first 6 months of the year and the second provisional tax return at the end of the year of assessment. You need a tax code if you receive salary wages income-tested benefit or other income which has tax taken out before you get paid.

Provisional income is an amount used to determine if social security benefits are taxable. This guide provides a handy introduction to the main ins and outs of provisional tax for sole traders freelancers and self-employed contractors in New Zealand. Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount.

Individuals companies and trusts that paid more than 2500 tax at the end of the year from their last return are required to pay provisional tax payable the following year. Provisional tax helps you manage your income tax. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year.

What happens next is that this 10500 gets divided into three equal instalments that. A provisional taxpayer is a person whose income accrues through other means other than salary. If your provisional tax paid is more than your RIT youll get a refund and may receive interest on the difference.

Provisional tax breaks up the lump sum of income tax by paying in instalments throughout the year on provisional and terminal tax dates. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. Provisional tax is a way of pre-paying income tax in stages.

When the year is audited. In the example we say. Provisional tax payments are due if you have a March balance date and use the standard estimation or ratio options.

Its payable the following year after your tax return. Prior to 1983 social security benefits were not subject to income tax. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return.

Its designed to help you avoid getting caught with a huge unexpected tax bill after completing your end-of-year accounts. You pay it in instalments during the year instead of a lump sum at the end of the year. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives remuneration from an employer who is not registered for employees tax for example an.

What is provisional tax. Your tax code might be different for different types of income. The assessment and the payment of the 1 st installment can be created via Tax Portal.

Euro 60000 125 7500. Find your tax code. NZ Meaning and Definition.

Provisional taxes are tax payments made throughout an income year. The level of income that is used to determine whether a taxpayer is liable for tax on his or her Social Security benefits and by how much. A payment code is provided by the Tax Portal system with which each tax instalment is paid through a bank transfer to the Tax Department.

Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code. 2500 before the 2020 return. It is paid by two equal installments on the 31 st of July and 31 st of December of each year in two equal installments for the given year.

Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC. A provisional taxpayer is defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No58 of 1962 as any.

Step By Step Document For Withholding Tax Configuration Sap Blogs

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

3 21 3 Individual Income Tax Returns Internal Revenue Service

Limited Liability Partnership Registration In Trivandrum Llp Parpella

Step By Step Document For Withholding Tax Configuration Sap Blogs

Best Startup Solutions Company Registration In India Complypartner Start Up Startup Company Digital Marketing Services

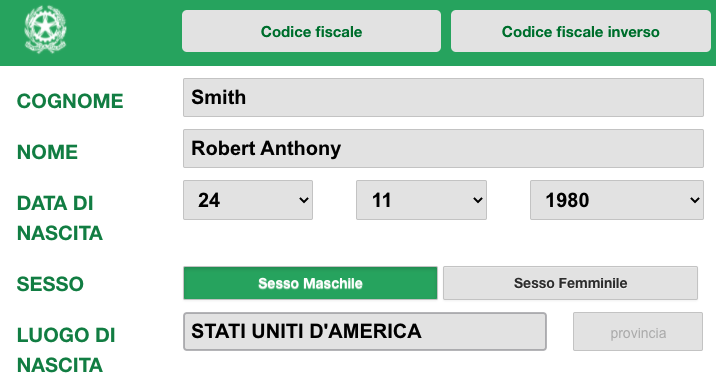

Italian Tax Code Codice Fiscale Studio Legale Metta

Tax Code Inps Insurance Coverage Health Care Scuolanormalesuperiore

Getting Your Tax Code Erasmus Blog Milan Italy

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

Step By Step Document For Withholding Tax Configuration Sap Blogs

How To Get The Italian Tax Code Yesmilano

Why You Need A Codice Fiscale In Italy And How To Get One Now

Step By Step Document For Withholding Tax Configuration Sap Blogs

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Step By Step Document For Withholding Tax Configuration Sap Blogs